Monthly Archives: October 2025

Franchise Location Analysis for Smarter Expansion

Source:https://franchiseindia.s3.ap-south-1.amazonaws.com

Expanding a franchise involves much more than simply opening new locations; it requires a strategic approach to ensure that each new site has the potential to thrive. One of the most important aspects of this expansion strategy is franchise location analysis. The process of evaluating potential locations goes beyond demographic data—it involves understanding customer behavior, traffic patterns, competition, and more. This article will explore how thorough franchise location analysis can help business owners make data-driven decisions that maximize profitability and reduce risks as they expand their franchise operations.

1. The Importance of Franchise Location Analysis

The success of any franchise is deeply tied to the location of its stores. A poor location can hinder customer acquisition, while a strategically chosen site can significantly boost visibility, foot traffic, and sales. Understanding why location matters in franchise expansion is key to crafting a successful growth strategy.

A. Traffic Flow and Accessibility

One of the first elements considered during franchise location analysis is the amount of traffic the area experiences. High traffic volume typically correlates with higher potential sales, especially for businesses that rely on walk-in customers. For example, a fast-food franchise may benefit from being located near a busy intersection, while a boutique store may find more success in a more pedestrian-friendly neighborhood or mall.

Additionally, the location should be easily accessible. Proximity to public transport, parking availability, and ease of entry can all influence a customer’s decision to visit. Businesses located in high-traffic areas with easy accessibility often see higher foot traffic, which is essential for growth.

B. Demographic and Economic Factors

Demographics play a critical role in determining the success of a franchise. Franchise location analysis involves examining the characteristics of the local population, including age, income levels, family size, education, and lifestyle preferences. Understanding the demographic profile of a given area ensures that the franchise is aligned with the purchasing power and needs of its target market.

For example, a health-conscious food franchise may perform better in an area with a higher concentration of young professionals or families with disposable income, while a children’s clothing store might be more successful in a neighborhood with a higher number of families.

Economic factors, such as the local economy’s overall health and consumer spending behavior, also influence location decisions. Areas with thriving businesses, high-income levels, and low unemployment rates tend to be better choices for expansion.

C. Competitive Landscape

The competitive landscape of a particular area should also factor into location analysis. If a neighborhood already has several competitors offering the same or similar services, the likelihood of capturing a significant market share decreases. Franchise location analysis should identify areas with low competition or gaps in the market that the franchise can fill effectively.

On the other hand, areas with intense competition could indicate high demand, but it also means that the franchise must differentiate itself clearly in terms of offerings, marketing, or customer experience to succeed. Analyzing competitors’ strengths and weaknesses helps franchise owners position themselves effectively.

2. Tools and Techniques for Conducting Franchise Location Analysis

In today’s data-driven world, franchise location analysis is not just an art but a science. A variety of tools and techniques can help franchise owners make informed decisions when choosing locations for expansion.

A. Geographic Information Systems (GIS)

Geographic Information Systems (GIS) are powerful tools that allow franchise owners to map out and visualize critical factors such as traffic patterns, demographic trends, and competitor locations. GIS tools provide data on consumer behavior, average income levels, and the proximity of other businesses that could either complement or compete with the franchise.

For example, GIS can reveal high-traffic areas where a franchise could benefit from visibility while also providing insights into customer behavior, helping owners pinpoint ideal locations. This technology allows for more accurate and efficient decision-making by providing a comprehensive analysis of geographical factors.

B. Market Research and Consumer Surveys

Conducting thorough market research through consumer surveys or focus groups is another important technique for franchise location analysis. Surveys can provide firsthand insights into the preferences, behaviors, and expectations of potential customers in a specific area. Knowing customer sentiment before making a location decision can help identify high-potential areas and avoid costly mistakes.

Market research also helps determine the right mix of products or services that would appeal to the local population, making it easier to customize offerings for each location’s unique needs.

C. Industry-Specific Benchmarks

In addition to demographic and economic data, industry-specific benchmarks provide valuable insights. These benchmarks allow franchise owners to compare performance metrics such as sales volume, customer foot traffic, and operating costs across various locations in the same industry. By assessing the performance of similar franchises, business owners can identify which location characteristics are most likely to lead to success.

3. Evaluating Risks and Long-Term Growth Potential

A thorough franchise location analysis also requires a long-term perspective. While short-term profitability is important, it’s equally critical to assess the location’s long-term growth potential. Factors such as area development, future real estate trends, and local government policies can significantly affect the sustainability of the franchise.

A. Local Government and Zoning Regulations

Before settling on a location, franchise owners should consider local government regulations, zoning laws, and any restrictions on certain types of businesses in the area. Some cities or regions may have restrictions that could hinder growth, such as limits on operating hours, signage regulations, or even restrictions on certain types of business activities.

Moreover, some local governments may offer incentives for new businesses, such as tax breaks or reduced rent, which could be valuable in evaluating the location’s cost-effectiveness over the long term.

B. Future Area Development

Franchise location analysis should also consider future area development. Look for neighborhoods or cities with plans for growth, such as new infrastructure projects, planned residential or commercial developments, or upcoming transportation projects. These factors can enhance the attractiveness of a location and help ensure that the franchise will continue to thrive as the area develops.

For example, a new residential development or a planned shopping mall can create new opportunities for businesses by increasing customer foot traffic.

C. Real Estate Costs

While it is important to choose a high-potential location, real estate costs should also factor into the analysis. In some cases, high-rent districts may not be worth the cost if the projected revenue does not justify the expense. A balance must be found between the location’s profitability potential and its real estate costs.

Franchise owners should assess long-term lease terms, rent escalations, and any additional costs that might impact the profitability of a location.

In conclusion, franchise location analysis is a crucial step in the expansion process that directly influences the success of a franchise. By taking into account factors such as traffic flow, demographics, competition, and local economic conditions, franchise owners can select optimal locations that maximize revenue potential while minimizing risks. The use of advanced tools like GIS, market research, and industry benchmarks further enhances the decision-making process, providing a data-driven approach to expansion. In the long term, evaluating growth opportunities and risks related to real estate and government regulations will help ensure the franchise’s sustained success. Through meticulous location analysis, franchises can make smarter expansion decisions and build a strong foundation for future growth.

Delegation Techniques for Effective Team Management

Source:https://www.upskillist.com

Effective team management is crucial to the success of any organization. One of the most powerful tools for a leader or manager is the ability to delegate tasks appropriately. Delegation techniques not only enhance productivity but also empower team members, encourage growth, and ensure that leaders can focus on higher-level responsibilities. However, many managers struggle with delegation, either by micromanaging or failing to allocate tasks efficiently. This article will explore the best delegation techniques that can help improve team management, build trust, and drive overall team performance.

1. Understanding the Importance of Delegation in Team Management

Delegation is a critical aspect of leadership, allowing managers to distribute tasks to team members based on their skills, strengths, and expertise. When done right, delegation fosters a collaborative work environment, increases efficiency, and motivates employees to take ownership of their work.

A. The Power of Trust

At the heart of effective delegation is trust. Managers need to trust their team members’ abilities to complete tasks independently. Micromanaging, on the other hand, undermines confidence and limits the team’s growth. When leaders delegate responsibilities effectively, they give employees the opportunity to demonstrate their skills, learn new ones, and ultimately contribute to the overall success of the organization.

B. Preventing Manager Burnout

Effective delegation also helps prevent burnout in managers. By distributing tasks appropriately, managers can focus on their strategic responsibilities rather than becoming bogged down with day-to-day operations. It allows leaders to work on areas such as planning, problem-solving, and improving team dynamics, which are essential for long-term success.

2. Key Delegation Techniques for Effective Team Management

To ensure that delegation is effective and not overwhelming for both the manager and the team, a few core delegation techniques should be implemented. These strategies focus on assigning the right tasks to the right people and ensuring there is clear communication and accountability throughout the process.

A. Know Your Team’s Strengths and Weaknesses

Effective delegation begins with understanding the unique skills, strengths, and weaknesses of each team member. Before assigning a task, assess who is best suited for the job. Is it a task that requires technical expertise, or does it need someone with strong communication skills? By assigning tasks based on the strengths of individual team members, managers can increase the likelihood of successful outcomes and boost team morale.

For example, if you have a team member with strong analytical skills, delegate them a project that involves data analysis. Similarly, someone with excellent writing skills could be responsible for creating reports or content.

B. Set Clear Expectations and Goals

When delegating tasks, it’s essential to set clear expectations and goals. Ambiguous instructions can lead to confusion, missed deadlines, or incomplete work. Be specific about what you want to be done, when you expect it to be completed, and what the final outcome should look like. This reduces the risk of misunderstandings and ensures that the task is completed to the desired standard.

Additionally, clarify the purpose of the task and how it aligns with the overall team or organizational goals. When employees understand the bigger picture, they are more likely to take ownership of their work and see the value in what they are contributing.

C. Provide the Necessary Resources and Support

Delegation doesn’t mean simply handing off a task and walking away. Managers must ensure that team members have the resources and support they need to succeed. This could include providing access to necessary tools, training, or knowledge, as well as being available for guidance if needed.

For instance, if you delegate a task that requires the use of a specific software or system, make sure the team member is trained on how to use it effectively. Additionally, make sure there is a clear line of communication in case the team member encounters challenges along the way.

D. Encourage Ownership and Accountability

One of the key delegation techniques is encouraging a sense of ownership and accountability. While it’s important to provide support, it’s equally crucial to allow team members to take full responsibility for their assigned tasks. This fosters a sense of trust and respect between the manager and their team and motivates employees to do their best work.

To promote ownership, empower team members to make decisions related to their tasks. Avoid constantly checking in or micromanaging, as this can stifle creativity and initiative. Instead, set clear deadlines, check in periodically, and offer constructive feedback when necessary.

E. Be Ready to Provide Constructive Feedback

Feedback is an essential part of the delegation process. After a task is completed, it’s important to review the work and provide constructive feedback. This helps team members learn from the experience, understand what they did well, and identify areas for improvement.

When giving feedback, be specific and objective. Praise efforts and successes, but also address any areas where the task could have been improved. A balanced approach helps team members feel valued and motivated to continue growing in their roles.

3. Overcoming Common Delegation Challenges

While delegation is an essential skill, it’s not always easy. Managers may face challenges such as lack of trust, fear of losing control, or uncertainty about whether the team member is truly capable of completing the task. Overcoming these challenges requires a shift in mindset and the willingness to let go of perfectionism.

A. Overcoming the Fear of Losing Control

One of the most common reasons managers struggle with delegation is the fear of losing control. It’s natural to want to oversee every aspect of a project, but this mindset can lead to burnout and inefficiency. The key is to trust your team and accept that there may be different ways to accomplish the same goal. Allowing team members to take ownership often leads to more creative solutions and better outcomes.

B. Building Trust Through Communication

Effective delegation requires strong communication between managers and team members. If you feel uncertain about delegating a task, have an open conversation with the employee about expectations, timelines, and possible challenges. Encourage an open dialogue where team members feel comfortable asking for help if needed. Over time, consistent communication will build trust and allow for more effective delegation.

C. Recognizing When to Delegate and When to Keep Control

While delegation is a powerful tool, there are times when it is not the best course of action. For example, if a task is highly specialized or requires a deep level of knowledge that only the manager possesses, it may be more effective to handle it personally. Similarly, if a project involves sensitive information or a critical decision that could have significant consequences, the manager should take the lead. Knowing when to delegate and when to retain control is a key skill in effective team management.

In conclusion, delegation techniques play a crucial role in effective team management. By understanding the strengths of your team members, setting clear expectations, and fostering ownership and accountability, managers can optimize team performance and achieve greater results. Effective delegation not only helps reduce burnout and improve productivity but also empowers employees to grow in their roles and contribute to the overall success of the organization. By overcoming challenges like the fear of losing control and communicating openly, managers can delegate tasks with confidence, ensuring that both the team and the business thrive.

Talent Acquisition Trends That Are Shaping the Workplace

Source:https://iamneo.ai

The landscape of recruitment and talent acquisition has undergone significant transformation in recent years, driven by technological advancements, changing workforce expectations, and the evolving dynamics of the global job market. As organizations strive to attract top talent in an increasingly competitive environment, understanding the talent acquisition trends that are shaping the workplace is crucial. These trends are not only revolutionizing the way companies approach hiring but are also redefining how employees view their roles, career growth, and work-life balance. In this article, we will explore the key trends influencing talent acquisition and how businesses can adapt to remain competitive in the future of work.

1. Emphasis on Candidate Experience

One of the most significant talent acquisition trends today is the growing importance of candidate experience. In the past, the hiring process was often one-sided, with employers focusing primarily on evaluating candidates’ qualifications and fit for the role. However, as the job market becomes more candidate-driven, companies are realizing the importance of offering a seamless, engaging, and positive experience for potential hires.

A. Streamlined Application Processes

Candidates increasingly expect a streamlined application process. Lengthy and complicated application forms are a major turnoff for top talent. Many organizations are now adopting intuitive, user-friendly application systems that allow candidates to apply quickly with minimal effort. Mobile-optimized applications, easy resume uploads, and automated responses are becoming the norm.

B. Transparent Communication

Clear and frequent communication throughout the recruitment process is vital for improving candidate experience. Applicants appreciate knowing where they stand, whether they are moving to the next stage or not. Employers who provide timely updates, feedback, and interview schedules build trust and demonstrate professionalism.

C. Personalization and Engagement

Personalization is another key aspect of enhancing candidate experience. Companies are increasingly using data and artificial intelligence to personalize their communications with candidates. Tailored emails, specific job recommendations, and custom onboarding content help candidates feel valued and engaged right from the start.

2. Use of AI and Automation in Recruitment

Another major shift in talent acquisition trends is the growing reliance on artificial intelligence (AI) and automation to streamline the hiring process. These technologies are reshaping how recruiters source candidates, conduct interviews, and even evaluate talent.

A. AI-Powered Screening

AI is now playing a pivotal role in candidate sourcing and screening. Many recruitment platforms use AI algorithms to scan resumes and match candidates with job descriptions. These tools can identify the most relevant skills, experiences, and qualifications, reducing the time spent by recruiters on manual screening. In addition, AI can also help identify unconscious biases, ensuring a more objective and diverse recruitment process.

B. Chatbots for Candidate Engagement

Chatbots are increasingly being used to engage with candidates, answer frequently asked questions, and schedule interviews. These AI-powered bots can provide immediate responses to candidate inquiries and even assist in pre-screening applicants. By automating these aspects of the process, HR teams can focus on more strategic tasks, such as building relationships with top-tier candidates.

C. Predictive Analytics

Predictive analytics is another AI-driven trend making its way into recruitment. By analyzing historical hiring data, predictive analytics tools can forecast which candidates are most likely to succeed in a given role, based on factors such as experience, skills, and cultural fit. These insights can help organizations make more informed, data-driven hiring decisions.

3. Focus on Diversity, Equity, and Inclusion (DEI)

Diversity, equity, and inclusion (DEI) have become central to modern talent acquisition strategies. Employers recognize that a diverse workforce drives innovation, enhances decision-making, and leads to better business outcomes. As such, DEI initiatives are playing a pivotal role in shaping recruitment practices.

A. Inclusive Hiring Practices

Organizations are increasingly adopting inclusive hiring practices to ensure they attract a diverse pool of candidates. This includes removing gendered language from job descriptions, implementing blind recruitment processes to reduce bias, and promoting equal opportunities for candidates from various backgrounds. DEI training for hiring managers and interviewers is also becoming a common practice to ensure fairness throughout the process.

B. Employee Resource Groups (ERGs)

Many organizations are also building internal employee resource groups (ERGs) that foster inclusion and support employees from underrepresented groups. These ERGs can play a vital role in both talent acquisition and retention, as they create a welcoming environment for diverse candidates and demonstrate the company’s commitment to inclusivity.

C. Diverse Sourcing Channels

To attract a diverse pool of candidates, many companies are expanding their sourcing channels. This includes partnering with diverse professional organizations, attending diversity-focused job fairs, and leveraging platforms that cater to specific demographic groups. By diversifying their sourcing efforts, organizations increase the likelihood of hiring candidates from varied backgrounds.

In conclusion, the talent acquisition trends shaping the workplace today are redefining how companies recruit and engage with potential employees. From improving candidate experience with streamlined processes and personalized communication, to leveraging AI and automation to enhance efficiency and objectivity, businesses are adopting innovative strategies to stay competitive. Moreover, the increased focus on diversity, equity, and inclusion ensures that organizations are not only attracting the best talent but also fostering an inclusive and innovative work environment. As these trends continue to evolve, it is essential for businesses to stay agile and adapt their recruitment strategies to meet the changing demands of the workforce, ensuring they attract, hire, and retain the right talent for future success.

Tax Planning Strategies for Business Exit Scenarios

Source:https://savageaccountancyandvaluation.com

When it comes to business ownership, planning for the future includes preparing for the inevitable exit, whether it be through a sale, merger, or retirement. One critical aspect of this process is tax planning for exit. The structure of the exit strategy can significantly impact the amount of taxes you will owe when the time comes to part ways with your business. Effective tax planning can minimize the tax burden, maximize the proceeds from the sale, and ensure the smooth transition of ownership. This article explores various tax planning strategies that business owners should consider when preparing for an exit, offering insights to reduce the financial impact of this important transition.

1. Understanding Tax Implications in Exit Scenarios

Before diving into specific tax planning strategies, it’s important to understand the primary tax implications in business exit scenarios. The taxes owed can vary significantly depending on how the business is structured (e.g., LLC, corporation, or sole proprietorship) and how the exit is executed.

A. Capital Gains Tax

One of the most common taxes that business owners face when exiting is capital gains tax. This tax is applied to the difference between the sale price of the business and its original purchase price or adjusted basis. For example, if you sell your business for $5 million and the adjusted basis is $1 million, the $4 million profit would be subject to capital gains tax.

There are two types of capital gains tax:

- Short-term capital gains (for assets held for less than one year), taxed at ordinary income tax rates.

- Long-term capital gains (for assets held longer than one year), typically taxed at lower rates.

Since capital gains taxes can be substantial, tax planning for exit is vital to minimize these liabilities.

B. Ordinary Income Tax

In some business exits, certain components of the sale might be subject to ordinary income tax rates instead of capital gains rates. For example, the portion of the sale that involves goodwill or employee stock options could be taxed as ordinary income, which typically carries higher rates than capital gains tax.

C. Depreciation Recapture

If your business owns depreciable assets, such as real estate or equipment, depreciation recapture may apply when selling those assets. This means you will have to “pay back” some of the depreciation deductions you’ve taken over the years, typically at a higher rate than capital gains.

D. Estate Taxes

For business owners who are preparing to pass on their business to heirs, estate taxes could become a concern. The value of your business may be considered part of your estate and could be taxed upon transfer. Effective planning can help reduce or eliminate estate taxes for your heirs.

2. Tax Planning Strategies for Business Exit

The key to reducing the tax burden when exiting a business lies in strategic planning. Here are some essential tax planning strategies for business owners:

A. Structure the Sale for Maximum Tax Efficiency

One of the most important decisions when selling a business is whether the sale will be structured as an asset sale or a stock/share sale. Each structure has distinct tax implications:

- Asset Sale: In an asset sale, the buyer acquires individual assets of the business (e.g., equipment, intellectual property, real estate) rather than the entire business entity. While this structure can allow the buyer to depreciate assets on a faster schedule, the seller may face higher taxes due to depreciation recapture and the treatment of goodwill as ordinary income.

- Stock/Share Sale: In a stock sale, the buyer purchases the business entity itself, including all its assets and liabilities. For the seller, this can result in more favorable capital gains treatment because the transaction is typically taxed at the lower long-term capital gains rate. However, this approach is often more advantageous for the seller when there are significant liabilities attached to the business.

Carefully weighing the pros and cons of both approaches in consultation with a tax advisor can help you choose the best option for minimizing taxes.

B. Utilize Retirement Plans and Employee Stock Ownership Plans (ESOPs)

If you’re planning on retiring after the exit, consider using retirement plans to shelter some of the income from taxes. For example, a 401(k) or a SEP IRA could allow you to defer taxes on a portion of the sale proceeds until retirement, potentially lowering your current tax liabilities.

An Employee Stock Ownership Plan (ESOP) could also be a valuable strategy. ESOPs allow business owners to sell the business to employees and defer taxes on the proceeds. This strategy can be particularly attractive for business owners who want to transition ownership to their employees while minimizing taxes.

C. Use of Trusts for Estate Planning

For business owners who are exiting with the intention of passing the business down to heirs, using irrevocable trusts can be an effective estate planning tool. Trusts allow business owners to transfer assets to beneficiaries while reducing estate taxes. The grantor retained annuity trust (GRAT), in particular, is a popular strategy for minimizing estate taxes while transferring ownership interests.

Additionally, utilizing charitable remainder trusts (CRTs) can help reduce capital gains taxes on the sale of a business, while also allowing the owner to support charitable causes.

D. Capital Gains Tax Planning with Tax Deferral Strategies

There are several strategies that allow business owners to defer capital gains taxes, which can be beneficial when selling a business. One of the most commonly used tax-deferral strategies is a 1031 exchange. While typically used for real estate, a 1031 exchange can also apply to certain types of business sales, allowing you to defer taxes on the sale of appreciated property as long as the proceeds are reinvested in similar property.

Another strategy is the Opportunity Zones program, which allows owners who sell their business or other assets and reinvest the proceeds into designated Opportunity Zones to defer capital gains taxes.

3. Key Considerations for Successful Tax Planning for Exit

While tax planning for exit is essential, it’s also important to approach the process strategically, considering both short-term and long-term goals. Here are some key considerations when preparing for your business exit:

A. Timing the Exit

Timing is critical in tax planning. The year in which you decide to exit can significantly affect the taxes you owe. For example, selling at the end of the year may allow you to take advantage of tax strategies in that fiscal year, while selling at the beginning of the year may give you more time to plan and defer taxes. Understanding the market, your business’s financial performance, and any upcoming tax changes can help you time your exit for maximum benefit.

B. Consult with Tax Professionals and Legal Advisors

Tax planning for exit can be complex, and each business exit scenario is unique. It’s vital to work with a team of tax professionals, accountants, and legal advisors who specialize in business sales. These experts can help you navigate the intricacies of tax law and structure the exit in the most tax-efficient way possible.

C. Review Your Exit Strategy Regularly

The tax landscape is constantly changing, so it’s important to review your exit strategy regularly. What works well today might not be as advantageous in a few years. By staying informed about changes in tax laws and business trends, you can adjust your strategy as needed.

In conclusion, tax planning for exit is an essential component of a successful business exit strategy. By carefully considering the structure of the sale, utilizing retirement plans, using trusts for estate planning, and exploring tax deferral strategies, business owners can minimize their tax liabilities and maximize their returns. Working with professionals to tailor these strategies to your unique situation will help ensure that your business exit is financially rewarding and efficient. Thoughtful tax planning today can lead to a more profitable and less stressful business exit tomorrow.

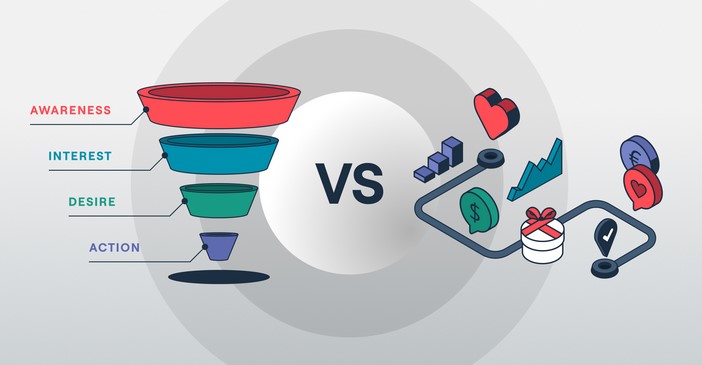

Breaking Down the Marketing Funnel Stages for Success

Source:https://huble.com

In the competitive world of digital marketing, understanding how to guide potential customers from awareness to purchase is critical. This journey, often referred to as the marketing funnel stages, is a framework that helps businesses structure their marketing efforts in a way that leads to conversions. The concept of the marketing funnel is based on the idea that prospects move through different stages before making a decision to buy a product or service. By breaking down these stages, businesses can tailor their marketing strategies to effectively engage with potential customers at each point in their decision-making process. In this article, we’ll explore the various stages of the marketing funnel and provide insights into how businesses can optimize each stage for success.

1. Understanding the Marketing Funnel Stages

The marketing funnel is a model that represents the customer journey, typically divided into three main stages: awareness, consideration, and decision. At each stage, potential customers have different needs and exhibit distinct behaviors, which means the strategies used to attract, engage, and convert them must be tailored accordingly. Here’s a closer look at each stage:

A. Awareness Stage

The awareness stage is the top of the funnel (TOFU), where potential customers first become aware of your brand, product, or service. At this stage, prospects may not be actively looking to purchase anything yet, but they are learning about solutions to problems they may have. The goal here is to increase visibility and attract a large number of leads, typically through content marketing, social media, paid ads, and search engine optimization (SEO).

Common tactics for the awareness stage include:

- Blog posts

- Infographics

- Videos

- Social media campaigns

- Paid ads

The focus here should be on providing educational, informative, and entertaining content that grabs attention. The primary aim is not to make a sale but to introduce your business to a broad audience and begin building trust.

B. Consideration Stage

Once prospects move beyond the awareness stage, they enter the consideration stage (middle of the funnel or MOFU). Here, they are more aware of their problem or need and are actively seeking solutions. They start to evaluate different products or services and compare options based on features, benefits, and pricing.

At this stage, your goal is to position your brand as a viable solution to their problem. You want to provide valuable information that helps prospects make an informed decision. This is where content like case studies, whitepapers, webinars, product comparisons, and email campaigns come into play. Prospects are looking for deeper insights and more detailed information about what you offer.

Effective tactics for the consideration stage include:

- Case studies or testimonials

- Product demos

- Webinars or live Q&A sessions

- Email nurture sequences

- E-books or guides

It’s important to provide prospects with content that addresses their pain points and outlines how your product or service can solve their specific challenges.

C. Decision Stage

The decision stage (bottom of the funnel or BOFU) is where prospects are ready to make a purchase decision. At this stage, they have already narrowed down their options and are now deciding on the best solution. Your task is to encourage them to take the final step and convert into paying customers.

In the decision stage, prospects are looking for incentives that will push them to act. This could include special offers, product demos, consultations, or customer reviews. Providing strong calls-to-action (CTAs) and making the purchasing process as simple as possible can be the key to closing the deal.

Effective tactics for the decision stage include:

- Free trials or consultations

- Discounts or special offers

- Detailed product descriptions or feature lists

- Customer reviews or success stories

- Easy checkout process

At this stage, you need to ensure that potential customers feel confident in their choice and are motivated to take action.

2. The Importance of Lead Nurturing Throughout the Funnel

While understanding the marketing funnel stages is crucial, it’s equally important to recognize the role of lead nurturing throughout the entire journey. Lead nurturing is the process of building relationships with potential customers and providing them with the right information at the right time.

Not every lead will be ready to make a purchase immediately, which is why nurturing is essential at each stage of the funnel. Here are a few lead nurturing strategies you can implement:

A. Personalized Email Campaigns

Email marketing is one of the most effective tools for lead nurturing. By segmenting your audience based on their behavior, interests, or position in the funnel, you can send personalized emails that address their unique needs and guide them through the next stage of the funnel.

B. Retargeting Ads

Retargeting ads are a great way to stay in front of leads who have interacted with your brand but haven’t converted yet. These ads can be tailored to the specific interests of the user, reminding them of your product or service and encouraging them to take action.

C. Social Proof and Testimonials

As prospects move through the funnel, they want reassurance that they are making the right choice. Sharing customer testimonials, case studies, and reviews can help build trust and reduce any doubts they may have before making a final decision.

D. Educational Content

Throughout the funnel, providing educational content can keep your leads engaged and moving towards conversion. Whether it’s through blog posts, videos, or in-depth guides, your content should be designed to answer questions, solve problems, and help prospects make informed decisions.

3. Optimizing Each Stage for Better Results

While understanding the marketing funnel stages is essential, optimizing each stage for maximum impact can significantly boost your conversion rates. Here are some strategies for optimizing each funnel stage:

A. Optimize the Awareness Stage

To succeed in the awareness stage, you need to ensure that your content is discoverable and resonates with your target audience. Focus on SEO, creating shareable content, and using social media effectively. By increasing your brand’s visibility, you’ll be able to capture a larger audience and move more prospects into the next stage of the funnel.

B. Engage During the Consideration Stage

In the consideration stage, your goal is to build trust and credibility. Provide in-depth content that addresses the specific needs and concerns of your prospects. You can also use marketing automation to personalize the content that prospects receive based on their behavior, ensuring that they get relevant information that nudges them toward making a purchase.

C. Close in the Decision Stage

The decision stage is where the magic happens. Ensure that your offers are compelling and that your prospects have a clear path to conversion. Highlight the benefits of your product, provide incentives like discounts, and make the buying process as easy as possible. A strong call-to-action can make all the difference in closing the deal.

In conclusion, understanding the marketing funnel stages and optimizing your strategies for each stage is vital for business success. By guiding your prospects through the awareness, consideration, and decision stages, you create a seamless journey that leads to higher conversions and improved customer relationships. Tailoring your approach to meet the specific needs of prospects at each stage ensures that you are providing the right content, the right incentives, and the right support to maximize the chances of turning leads into loyal customers.

Profit and Loss Statement: A Guide for Small Business Owners

Source:https://fekrait.com

Understanding the financial health of your business is crucial for making informed decisions and ensuring long-term success. One of the most important financial documents that every small business owner should be familiar with is the profit and loss statement. This document provides a clear snapshot of a business’s financial performance over a specific period, typically a month, quarter, or year. By analyzing this report, small business owners can better assess their profitability, identify potential cost-saving opportunities, and make strategic plans for the future. In this guide, we’ll explore the key components of a profit and loss statement and how to use it effectively to manage your business finances.

1. What is a Profit and Loss Statement?

A profit and loss statement (also referred to as an income statement) summarizes a company’s revenues, costs, and expenses incurred during a specific period, usually a fiscal quarter or year. It is a critical financial document used to assess the operational efficiency of a business. This statement helps business owners, investors, and creditors understand how revenue is transformed into net income or net profit.

The basic purpose of a profit and loss statement is to determine whether a business is making a profit or suffering a loss. It lays out how much money the company made from sales (revenue), how much it spent on operating costs, and what remains after all expenses are accounted for (net profit or loss).

Key Components of a Profit and Loss Statement

- Revenue (Sales): This is the total income from the sale of goods or services. It’s typically the first section on the report and is crucial as it reflects the money coming into the business.

- Cost of Goods Sold (COGS): This category includes all costs directly tied to the production of goods or services sold, such as raw materials, labor, and manufacturing costs.

- Gross Profit: Gross profit is calculated by subtracting the cost of goods sold from total revenue. This is a key indicator of how efficiently a company is producing and selling its products or services.

- Operating Expenses: These are the ongoing costs necessary to run the business but are not directly tied to production. Examples include rent, utilities, salaries, and marketing expenses.

- Operating Profit: This is the profit a company makes after deducting operating expenses but before accounting for interest and taxes. It’s an important metric that shows how much money the business is generating from its core operations.

- Net Income (Net Profit or Net Loss): The final figure on the statement, this represents the bottom line of the business. It’s calculated by subtracting all expenses (including taxes and interest) from revenue. If the result is positive, the business is profitable; if negative, the business is operating at a loss.

2. Why is a Profit and Loss Statement Important for Small Businesses?

A profit and loss statement is not just a tool for accountants or financial professionals; it is an essential document for business owners. Here are several reasons why small business owners should regularly review their profit and loss statements:

A. Financial Health Monitoring

By regularly generating a profit and loss statement, small business owners can track the financial health of their business over time. This allows them to quickly identify trends, such as increasing expenses or declining revenues, and take corrective actions before these issues become more serious.

B. Decision-Making

A well-prepared profit and loss statement helps business owners make data-driven decisions. Whether deciding on pricing strategies, cutting down on unnecessary expenses, or evaluating the profitability of different product lines, this document provides valuable insights that guide decision-making.

C. Budgeting and Forecasting

The profit and loss statement is a key tool for budgeting and forecasting future financial performance. By analyzing past periods, small business owners can forecast future revenue and expenses, helping them plan for growth, manage cash flow, and avoid surprises.

D. Securing Financing

When applying for a loan or attracting investors, a profit and loss statement is often one of the key documents required. Lenders and investors rely on this financial statement to assess whether the business is financially sound and whether it can repay debts or generate returns on investments.

3. How to Read and Interpret Your Profit and Loss Statement

Reading and interpreting a profit and loss statement might seem complicated at first, but once you understand the structure and what each number represents, it becomes much easier to identify areas of strength and potential problems in your business. Here are some tips for making sense of your report:

A. Compare Revenue and Expenses

Start by comparing your revenue against your expenses. If your revenue is growing but your expenses are also increasing at a similar rate, this could indicate inefficiencies in your business model. On the other hand, if your revenue is growing faster than your expenses, this is a sign that your business is becoming more profitable.

B. Look at Gross Profit Margins

Gross profit margin is one of the most important metrics in a profit and loss statement. It’s calculated by dividing gross profit by total revenue. A higher gross profit margin indicates that your business is effectively managing its production costs. If this number is decreasing over time, you may need to review your pricing strategy or explore ways to reduce production costs.

C. Evaluate Operating Expenses

Operating expenses can vary widely depending on the nature of the business. However, consistently high operating expenses relative to revenue can be a red flag. Analyzing this section can help you identify areas where you may be overspending, allowing you to take corrective action.

D. Watch for Trends in Net Income

The final figure, net income, is your bottom line. If your business is consistently making a profit, that’s great, but if your net income is negative for multiple periods, you need to take a close look at your revenue generation and cost control strategies. Negative net income could signal the need to revise business practices or consider new revenue streams.

In conclusion, understanding and regularly reviewing your profit and loss statement is essential for the financial success of your small business. It provides a clear view of your company’s financial health, helps you make informed decisions, and is a critical tool for future growth. By mastering the key components of this statement and using it to monitor your business performance, you can ensure that your small business stays on track toward profitability. Whether you’re trying to improve your cash flow, reduce costs, or evaluate your pricing strategy, a profit and loss statement is your key to understanding and optimizing your business’s financial performance.